|

TARGET 1 Price: 33.14 Profit: 27.5% Stop/Trailing Stop: 24.2 Loss: 6.9% P/L Ratio: 4 : 1 - Excellent TARGET 1 Price: 217.97 Profit: 16% Stop/Trailing Stop: 182.77 Loss: 2.7% P/L Ratio: 5.9 : 1 - Excellent TARGET 1 Price: 5.93 Profit: 22.8%

Stop/Trailing Stop: 4.51 Loss: 6.6% P/L Ratio: 3.5 : 1 - Good

0 Comments

TARGET 1 Price: 237.26 Profit: 14.6% Stop/Trailing Stop: 200.97 Loss: 2.9% P/L Ratio: 5 : 1 - Excellent TARGET 1 Price: 18.95 Profit: 27.3% Stop/Trailing Stop: 14.04 Loss: 5.7% P/L Ratio: 4.8 : 1 - Excellent TARGET 1 Price: 64.88 Profit: 8%

Stop/Trailing Stop: 58.54 Loss: 2.6% P/L Ratio: 3.1 : 1 - Good Rules of Engagement Generally, the rules for trading are simple:

Play only probabilities that favor a win. There isn’t a lot of detail provided here, because this aspect is covered in all the previous Academy sections. There are many ways to locate trades with a high probability of winning. The point that might not be so obvious is that you should only enter trades in which you can clearly articulate the reasons for doing so. An example of articulating a reason for entering the trade might be, “The stock is sitting on a known support level, and at least two indicators show it has reversed its trend and is likely to move much higher.” An example that is not very good articulation would be, “This sucker is going up!” or, “I just have a hunch it will make a big move.” Remember the insurance company and the casino: Neither of them “gamble” on a hunch. They have clear and proven rules of engagement. Do not be under funded. The most obvious example of being under funded is starting with a trading account that is too small to even overcome commissions. If this is the case, you shouldn’t trade, because you are giving up your edge of probability. Imagine if a casino opened up with only $100 in the cashier cage. While it is possible that all the players lose (and hence, bankroll your operation), it is highly probable you will go broke with only $100 in the bank; the slightest winning streak from a few players could wipe you out. So it goes with trading. If you start too small, you won’t be able to absorb an inevitable “losing streak” that you would otherwise take in stride. Don’t throw away your edge in probability by being under funded! What are sufficient funds? You can roughly use the following guidelines. Note that these guidelines are for stock trading, as trading in options will be different.

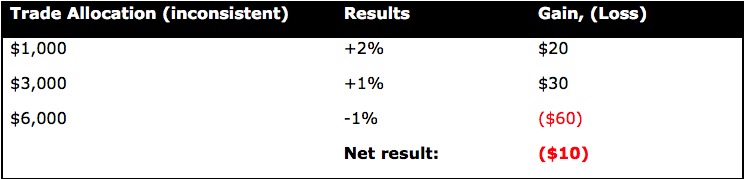

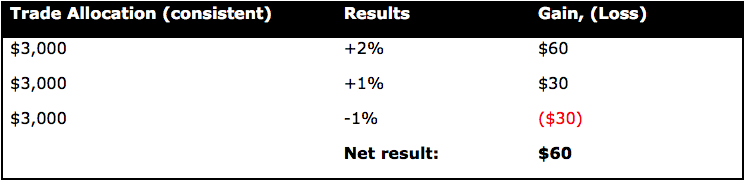

If each trade needs to be $2,800, your trading power needs to be $11,200 (since you never want to commit more than ¼ of your trading power for each trade). Note the term trading power, which might be different than your account cash value. A margin account, for instance, will let you trade 2X your cash, so your cash value could be $5,600 to have sufficient backing ($5,600 X 2 = $11, 200). Never let a loss significantly damage your trading power. There are a number of ways this can happen, but let’s look at the most common problems. First, it is essential that your trade allocations remain consistent. Never “load up” or engage in unequal amounts. If you are allocating ¼ of your trading power to each trade, then stick to that---no more, no less. It doesn’t matter how “sure” the trade seems to be, the allocation should always be the same. And by “same” we mean dollar amount, not share amount. For example, if ¼ of your trading power is $3,000, then each of your trades should be $3,000. Of course, this doesn’t need to be exact, you can approximate, but try not to fudge more than plus or minus 10%. Let’s illustrate what can happen if you violate this rule. Let’s say your trade allocation should be $3,000, but you decide to only trade $1,000 out of caution. You have a solid 2% gainer, so you bag $20. Feeling confident, your next trade is the correct allocation of $3,000, and this time you gain a modest 1%. Feeling confident, you decide to go “all out” on a solid play and you make a trade for $6,000. It doesn’t go your way, so you manage to bail out at a 1% loss. The problem with these variations is that you are now underwater, whereas you should be ahead had you followed the $3,000 allocation rule. Let’s take a look at these results: Now look at the results had you allocated the proper amounts for each trade: When you second-guessed the allocations, you lost $10. When you allocated proper (and equal) amounts, you gained $60---a $70 swing!

Another way of crippling your trading power is to let a loser run too deeply. Unfortunately, this is probably the most common mistake that beginning traders make---the inability to accept (and take) a loss. The rule of thumb should be this: Never allow a trade to sink beyond a level in which a reasonable recovery is not possible. What constitutes “reasonable” depends on what your typical winning trades return. If you are routinely bagging 2% gainers, it is unrealistic that you can recover from a loss greater than 2%. Of course, there are certain cases when you have no control over a loss (holding overnight, for example, might produce losses that you had no way of controlling), but you should never allow a losing position to go beyond what can be recovered realistically---when you do have control. Be willing to take a loss when holding longer will damage your chances of recovery. Always look at the bigger picture! TARGET 1 Price: 85.39 Profit: 10.4% Stop/Trailing Stop: 75.2 Loss: 2.8% P/L Ratio: 3.7 : 1 - Good TARGET 1 Price: 26.76 Profit: 12.7% Stop/Trailing Stop: 22.81 Loss: 3.9% P/L Ratio: 3.3 : 1 - Good TARGET 1 Price: 31.75 Profit: 12.1%

Stop/Trailing Stop: 27.49 Loss: 3% P/L Ratio: 4 : 1 - Excellent |

BlogAdvisory service that offers real-time and end of the day trading ideas. Archives

April 2024

Categories |

RSS Feed

RSS Feed