|

Swingstocktraders.com is a well-known online service for swing and day-trading, primarily in the S&P500 and NYSE universe. Swing-traders combines an advanced chart trend analysis, chart patterns recognition, and technical indicators tool into a powerful stock market timing system.

Our system will help you to find good trades, develop discipline, and avoid the traps of emotional trading. By using technical analysis you will step away from the crowd of amateurs and become a successful trader. Stock Signals application runs a complex technical trading strategy to generate daily “Buy” and “Sell” signals of varying degrees for all US stocks, options and ETFs. Our stock signals can be used for day traders and swing traders. The trading model that runs behind this application is based on technical analyses. As various swingstocktraders.com reviews reveal, the accuracy of stock tips is reasonably high and gives investor a great support system for their investment decisions. The best part of swingstocktraders.com is that they keep the expectations realistic and make you aware of the risk involved in a trade. What does the service include? Swingstocktraders.com provides tips that are very clear, instructive and thorough. They also provide timely market commentary through the blog that is delivered virtually to any device. You get alerts on mobile, through Boxcar or email, so that you do not miss any opportunity, even when you are not on your computer. The service provides investors entry and exit points in the stocks and makes them aware of the risk involved in the trade, so that investors can make informed decisions. Swing-trade and day-trade tips are important for traders who wish to take advantage of the volatility and opportunities presented by stocks in this space. Conclusion: Swingstocktraders.com is a good service for getting stock market tips. The timely delivery of tips on mobile through boxcar and on emails helps the investors to make quick decisions. While we believe that subscription is now very cheap and ideal for starters. You're not committed to anything you can stop per month with the tips. This feel comfortable while purchasing this service. We believe that swingstocktraders.com is a great supplementary service for the new and sophisticated investors! Swingstocktraders do all the homework for you. We do think that the subscription in the future will be higher. The $ 9.95 per month for this service can be called extremely low. Similar online service costs $ 45 or more. Many investors appear to be quite bearish on YY Inc , especially if you look at the percentage of the float that is sold short for this stock. Currently, 43.9% of the float is sold short, suggesting an extreme level of bearishness for YY. However, it is worth noting that earnings estimates have actually been moving higher for the company, despite the pessimism. Thanks to these rising estimates, we like the stock, so we clearly don’t believe in the negativity surrounding this firm, and are instead looking for shares of YY to move higher in the weeks ahead. $EV recently dipped below strong support at the $36.00 level but has since climbed back above this price and this offering a good entry point.

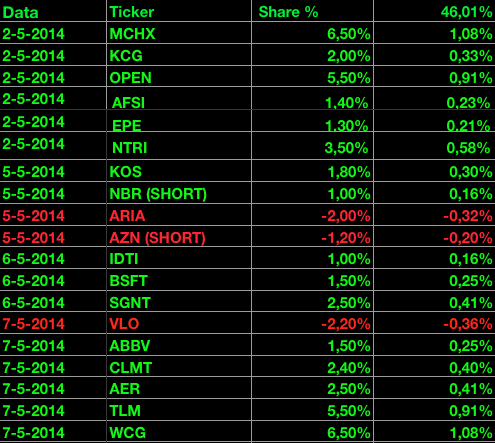

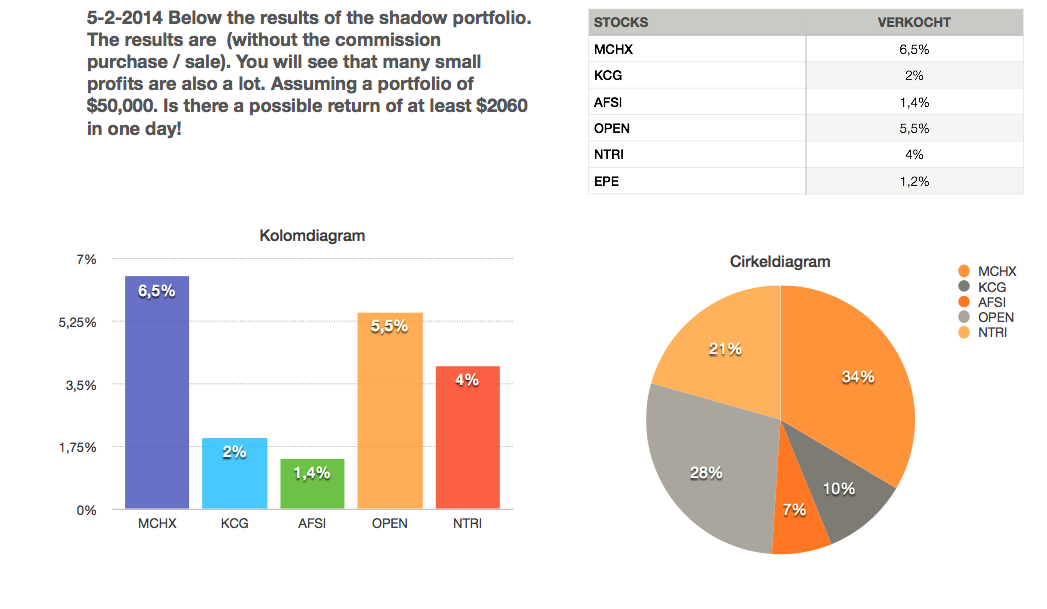

Earnings Per Share $1.70 (TTM As of Jan. 2014) Eaton Vance Corp's diluted earnings per share (Diluted EPS) for the three months ended in Jan. 2014 was $0.56. Its diluted earnings per share (Diluted EPS) for the trailing twelve months (TTM) ended in Jan. 2014 was $1.70. Eaton Vance Corp's basic earnings per share (Basic EPS) for the three months ended in Jan. 2014 was $0.59. Its basic earnings per share (Basic EPS) for the trailing twelve months (TTM) ended in Jan. 2014 was $1.80. Eaton Vance Corp's earnings per share without non-recurring items for the three months ended in Jan. 2014 was $0.57. Its earnings per share without non-recurring items for the trailing twelve months (TTM) ended in Jan. 2014 was $1.74. During the past 12 months, Eaton Vance Corp's average earnings per share (NRI) Growth Rate was -2.20% per year. During the past 3 years, the average earnings per share (NRI) Growth Rate was 3.60% per year. During the past 5 years, the average earnings per share (NRI) Growth Rate was 10.30% per year. During the past 10 years, the average earnings per share (NRI) Growth Rate was 6.20% per year. During the past 13 years, Eaton Vance Corp's highest 3-Year average earnings per share (NRI) Growth Rate was 58.70% per year. The lowest was -2.90% per year. And the median was 10.10% per year. Today real super profits with our buying tips! All 5 tips more than 1.5% gain.

With the big winners WCG +6% and $TLM +5.5% and that for only $ 9.95 per month! Almost unbelievable. You can today easily earn the cost of membership for the whole year. |

BlogAdvisory service that offers real-time and end of the day trading ideas. Archives

April 2024

Categories |

RSS Feed

RSS Feed