|

Working with an AI trading system has been an incredibly rewarding experience. It's truly fascinating to witness how the system adapts to the volatile nature of the stock market in such a short span of time. This Monday, we celebrated another impressive profit with a few well-executed trades. This achievement is particularly noteworthy given the market's restlessness just last week.

The real beauty of this AI trading system lies in its ability to eliminate the emotional uncertainties that typically accompany such periods. It has become a reliable partner in navigating the fluctuations and uncertainties of the stock market. Each day brings a sense of excitement as I eagerly anticipate the opportunity to collaborate with the AI trading system once again. One of the most remarkable aspects is its simplicity, which doesn't compromise its profitability. In fact, our gains have been substantial, and the ease with which the system operates is truly remarkable. Moreover, the cost-effectiveness of this solution is undeniable in our case, making it an even more attractive proposition. In summary, this AI trading system has transformed the way I approach the stock market. It has empowered me to overcome emotional insecurities during turbulent periods, providing consistent profitability and newfound confidence. I can confidently recommend this system to anyone looking to enhance their trading experience. Here's to more prosperous days ahead with our trusty AI trading companion!

0 Comments

Introduction: Greetings, fellow investors, both seasoned and new! Today, I'd like to share some insights into the world of investing, particularly the two major approaches that guide our decision-making process: fundamental analysis and technical analysis. As a seasoned investor with years of experience, I've witnessed the evolution of these strategies and their impact on the market. Let's delve into the fascinating realm of technical analysis and its historical origins.

The Advent of Technical Analysis: In the ever-evolving landscape of investing, one approach that has stood the test of time is technical analysis. This art has undergone significant refinement over the years, with roots tracing back to legendary figures like Jesse Livermore, a trading luminary from the late 1800s to the early 1900s. Livermore's uncanny ability to anticipate stock price movements by closely observing the ticker tape marked the early stages of what we now call technical analysis. By keenly analyzing the characteristics of the ticker tape, Livermore discerned patterns that hinted at future price movements. Essentially, he was tapping into the collective mindset of the market, extracting insights from the composite opinions of all those involved in stocks. This practice, known as "tape reading," eventually evolved with the introduction of charts, and further progressed through the advent of computers and the internet. Today, technical analysis has transformed into a rich repository of knowledge encompassing the study and interpretation of charts. This approach enables us to decipher potential future directions of stocks and commodities based on historical price patterns. The Fundamental Debate: In the world of investing, we encounter two primary schools of thought: fundamental analysis and technical analysis. Fundamental analysis centers around understanding the intrinsic value of a stock or commodity by studying the underlying companies, their financials, and the economic conditions they represent. On the other hand, technical analysis focuses on predicting price movements through chart patterns. Enthusiasts of both fundamental and technical analysis tend to champion their chosen method. Some proponents of fundamental analysis dismiss technical analysis as mere "chart junkies," akin to fortune tellers or tea leaf readers. Fundamentalists assert their superiority, citing the belief that a stock's value is ultimately driven by tangible financial and economic factors. For instance, if a company exhibits robust growth, this growth should eventually be mirrored in its stock price, causing it to rise. However, a significant hurdle accompanies fundamental analysis: The Knowledge Conundrum: No matter how much time you invest in fundamental analysis, there's an inescapable truth: Any information you uncover about a company is likely known to a multitude of others. Countless individuals, research firms, and financial institutions tirelessly scrutinize every facet of the market day in and day out. They dissect companies, interview executives, and absorb information at an astounding rate. In this hyper-connected age, your research is unlikely to yield insights that are not already widely acknowledged – at least not legally. The competitive nature of the market means that stock prices already incorporate the knowledge garnered by these extensive efforts. In essence, the research conducted by these entities has already been "priced in," leaving you without a distinctive edge. Conclusion: As a new investor, understanding the dichotomy between fundamental and technical analysis is crucial. While fundamental analysis delves into the core aspects of a company's value, technical analysis draws from historical price patterns to anticipate future movements. Recognizing the limitations of fundamental analysis – the challenge of finding unique insights amid a sea of existing information – empowers us to explore alternative strategies like technical analysis. Ultimately, a holistic approach that integrates elements of both fundamental and technical analysis can yield a more comprehensive understanding of the complex and dynamic world of investing. Embrace these insights, and embark on your investment journey with an open mind and a willingness to adapt in this ever-evolving landscape. Happy investing! Hey there, fellow traders and investors!

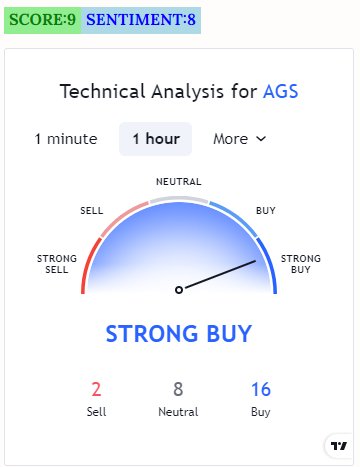

We've got some exciting news to share! At the request of our valued customers, we've revamped our rating system, making it even more versatile and beneficial for all of you. Now, not just one, but two ratings are available for each share. The first rating, the "Score," represents the short-term outlook, helping day traders make informed decisions and seize those quick opportunities in the market. The second rating, on the other hand, reflects the sentiment for a longer swing trade, catering to swing traders with varying time frames (short, and medium-term). This enhancement in our tools means that a broader group of investors can now benefit from our platform. Whether you're a day trader looking for fast-paced action or a swing trader planning for those more extended market moves, we've got you covered. And the best part? Our services remain incredibly affordable, making it accessible to everyone! For just $16.95 per month, you can take advantage of our upgraded ratings and optimize your trading strategies like never before. So, what are you waiting for? Join our community today and gain an edge in the ever-changing world of finance. Let's make those profits together! Happy trading, |

BlogAdvisory service that offers real-time and end of the day trading ideas. Archives

April 2024

Categories |

RSS Feed

RSS Feed