|

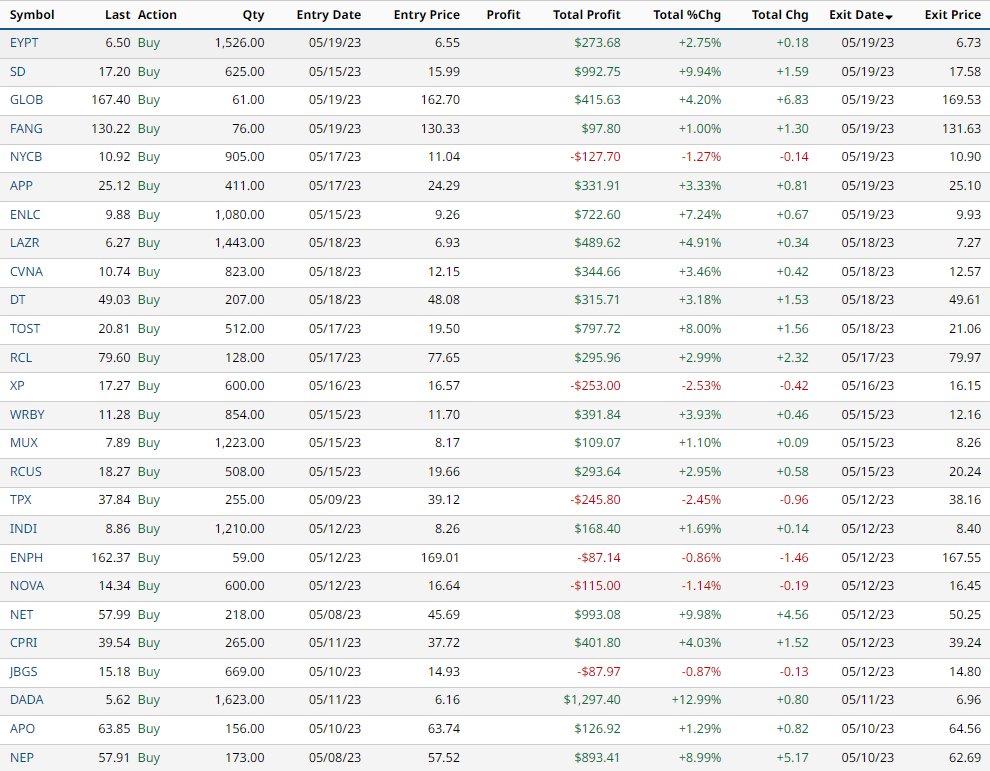

As an experienced investor, our decision to sell all the stocks on Thursday was driven by our deep understanding of market dynamics. We observed a significant surge in prices on that day and based on historical patterns, we anticipated that many investors would take profits on the following day. This trend is commonly observed after a sharp increase in prices within a single trading session.

By selling our stocks before the expected profit-taking, we aimed to maximize our gains. In volatile markets like the current one, it can be challenging to predict the market's next move. Therefore, it is crucial to capitalize on favorable opportunities when they arise. We recognized that the market sentiment could quickly shift, leading to potential downturns or corrections. It's important to note that this phenomenon tends to diminish during prolonged bullish periods when investor confidence remains high. However, in the current market conditions, where uncertainty and volatility prevail, investors tend to take profits earlier, even when they have only reached their breakeven point. As top investors, our strategy is to leverage our experience and knowledge to make informed decisions that align with the market trends and maximize returns. By carefully monitoring market movements and identifying patterns, we strive to optimize our trading activities and generate substantial profits for our clients.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

BlogAdvisory service that offers real-time and end of the day trading ideas. Archives

April 2024

Categories |

RSS Feed

RSS Feed