|

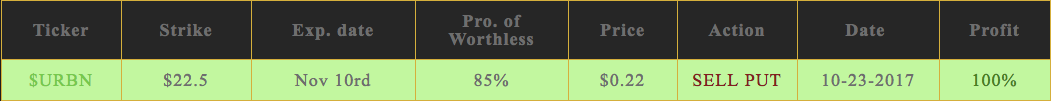

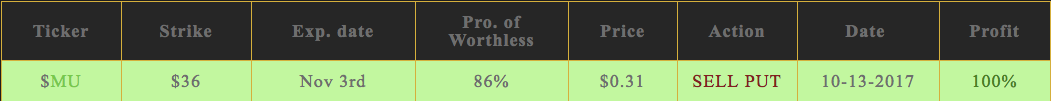

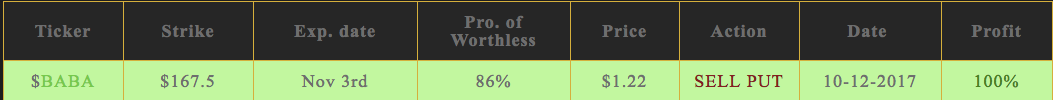

We send the last month three *free* options tips. All three makes a 100% profit! We start two months ago with de new service and it works great! This trading method is for de lazy traders, ore people that work on daytime. In a view minutes a day you make nice profits. We send you de follow information about the trade. You only have to buy or sell the options. Join us for only $21.95 Why Selling Options Is The Key To Success!

If there is one way that the most people lose money, it lies in buying options, whether they are call or put options. We have reproduced in part an article published in Futures magazine, March 2003, Option Sellers vs. buyers: Who wins? By John F. Summa. The article reads as follows:Option traders rarely take into account a little known underlying fact about these derivative markets: Most options expire “Out-Of-The-Money” A study analyzing three years of data compiled by the Chicago Mercantile Exchange (CME) confirms it. That means buyers lose on most option trades. Serious option traders need to think of formulating a net option writing method to get the best from the market. One can see that three patterns emerge from the CME data;

Over 20 million options expired worthless. Over 6 million options that were exercised resulted in them being “In-The Money”. The options that are “In-The-Money” at expiration will be exercised automatically. We can also see different patterns from the data, such as: a trend bias affecting the percentage of call options and put options that end up becoming worthless. Clearly, however, the overall pattern was that most options expired worthless. As a whole, S&P 500 recorded the highest percentage with 82.6% of put options expiring “Out-Of-The-Money or worthless”. This percentage was above the average for the whole study-76.5% of all CME Futures options expired worthless- and due to the stock index options on futures (NASDAQ 100 and S&P 500) having very large number of put options expiring worthless-more than 90%. During the period, there were a few short-lived declines in the market. However, because of bullish bias of stock indexes favored put seller during the period. Data for 2001-03, however, would no doubt show a shift toward more calls expiring worthless, reflecting the change in a primary bear market trend since 2000. Here are some of the main reasons in favor of options selling vs. buying:

You may not have to place a stop loss order when you sell puts as in the worst case you will end up owning the stock at a price that you intended to buy at. 2. Time in your favor: This is one of biggest advantages of selling options instead of buying them. Every option has two values. One is intrinsic value and the other is the time value. Even if the stock does not move against the trend, time value of the options will keep on eroding every day. Thus the option is of lesser value every day while the opposite is true when you sell options. The seller gains every day, even if the stock does not move at all. 3. Earn interest on other’s money; When you sell options, it adds money to your account. Even though you may not be able to withdraw it, you earn interest on the money every day until the day of expiration. The opposite is true when you buy options. In this regard, you have to be very careful in selecting the right brokerage company. The majority of brokerage companies don’t pay interest on the money which is accumulated by selling options. Down side of selling Options:

2. Limited Profit: The seller of an option definitely has this disadvantage. The seller cannot possibly make more than the amount that he/she sold the option for. I did extensive research and tested many options trading strategies and now I want to educate people and show them what I learned in the options trading business. You will understand how my trades have a minimum success rate of over 90% for the last 6 years. Put writing is an essential part of options strategies. Selling a put is a strategy where an investor writes a put contract, and by selling the contract to the put buyer, the investor has sold the right to sell shares at a specific price. Thus, the put buyer now has the right to sell shares to the put seller. Selling a put is advantageous to an investor, because he or she will receive the premium in exchange for committing to buy shares at the strike price if the contract is exercised. If the stock's price falls below the strike price, the put seller will have to purchase shares from the put buyer when the option is exercised. Therefore, a put seller usually has a neutral/positive outlook on the stock or expects a decrease in volatility that he or she can use to create a profitable position. Why Would You Consider This Strategy? Put writing can be a very profitable method, not only for generating income but also for entering a stock at a predetermined price. Put writing generates income because the writer of any option contract receives the premium while the buyer obtains the option rights. If timed correctly, a put-writing strategy can generate profits for the seller as long as he or she is not forced to buy shares of the underlying stock. Thus, one of the major risks the put-seller faces is the possibility of the stock price falling below the strike price, forcing the put-seller to buy shares at the strike price. Also note that the amount of money or margin required in such an event will be much larger than the option premium itself. These concepts will become clearer once we consider an example. Instead of using the premium-collection strategy, a put writer might want to purchase shares at a predetermined price that is lower than the current market price. In this case, the put writer would sell a put at a strike price below the current market price and collect the premium. Such a trader would be eager to purchase shares at the strike price, and as an added advantage he or she makes a profit on the option premium if the price remains high. Note, however, that the downside to this strategy is that the trader is buying a stock that is falling or has fallen. An Example Say XYZ stock trades for $75 and its one-month $70 puts (strike price is $70) trade for $3. Each put contract is for 100 shares. A put writer would sell the $70 puts into the market and collect the $300 ($3 x 100) premium. Such a trader expects the price of XYZ to trade above $67 in the coming month, as represented below: We see that the trader is exposed to increasing losses as the stock price falls below $67. For example, at a share price of $65, the put-seller is still obligated to buy shares of XYZ at the strike price of $70. He or she therefore would face a $200 loss, which is calculated as follows: $6,500 (market value) - $7,000 (price paid) + $300 (premium collected). Case Closed To close out the outstanding put prior to expiry, the put-seller would purchase back the put contract in the open market. If the stock's price has remained constant or risen, the put seller will generally earn a profit on his or her position. If, however, the price of XYZ has fallen dramatically, the put-seller will either be forced to buy the put option at a much higher price or forced to purchase the shares at above-market prices. In the case of XYZ stock trading at $65, the put-seller would either be forced to pay at least $500 to repurchase the put at expiry or forced to have the shares "put" to him or her at $70, which will require $7,000 in cash or margin. Note that in either scenario, the put seller realizes a $200 loss at expiry. The Bottom Line Selling puts can be a rewarding strategy in a stagnant or rising stock, since an investor is able to collect put premiums without incurring significant losses. In the case of a falling stock, however, a put seller is exposed to significant risk - even though the put seller's risk is limited. In theory, any stock can fall to a value of 0. Thus, in the case of our example, the worst-case scenario would involve a loss of $6,700. As in any option trade, always make sure that you are informed about what can go wrong.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

BlogAdvisory service that offers real-time and end of the day trading ideas. Archives

April 2024

Categories |

RSS Feed

RSS Feed